Important news for customers regarding their mortgage payment holiday

September 6, 2020

Technological investment enhances Society’s customer service during pandemic

The investment the Society has made into new technology and adaptations to our front-line services, over the last twelve months, has given our customers more choice about how they access their accounts, and enabled our staff to work seamlessly to ensure business continuity and customer service.

The changes implemented by the Society during the Covid-19 pandemic have, undoubtedly, contributed to what looks set to be a record year, running contra to the negative trends seen in other areas of the country’s economy.

Implementation of our digital service, Swansea Online, was brought forward due to the pandemic, following a significant investment in research and development. We would like to stress, however, that it has been introduced to compliment the Society’s branch premises in Swansea, Mumbles, Carmarthen and Cowbridge, not replace them, and allow customers more options to access their accounts – particularly helpful during lockdown periods.

The digital service aims to strike the right balance between allowing customers easy access to their accounts around the clock, 7 days a week, while offering security, assurance, and choice. It has been a great success, with over 1,700 customers signing up in the first few months.

To enhance speed and resilience, upgrades were also made to all branch internet connections, and customers are also now able to withdraw funds to their nominated accounts via email, post and telephone request.

To ensure business and customer service continuity during lockdown, we introduced an innovative VoIP telephone system, which diverts incoming calls to our employees’ laptops, allowing them to work from home and still use their works landline.

To maintain our commitment to opening and not closing branches, we ensured that all branches remained open for socially distanced face-to-face transactions, with staff working on a rota of one week at home and one week at the branch, restricting the number of staff in the branch at any one time. Adjustments were also made to premises to ensure staff and customer safety in accordance with Government guidelines.

Despite the pandemic, the Society has continued to recruit staff across the business. This has been achieved by utilising video conferencing software to undertake interviews. Microsoft Teams and Zoom have also been used for all team meetings and to enhance our employees’ connectivity while working remotely.

Alun Williams, our Chief Executive Officer, said:

“We are very proud of the way the Society has adapted to the very challenging circumstances this year. All of the technology and other adaptations we have implemented have been designed solely with the aim of allowing more flexibility for our customers, whilst keeping them and our staff safe in compliance with Government regulations and advice.

“We have been delighted by the way in which our customers have embraced the new technology, and we look forward to encouraging even more members to use it in the future while adding to its functionality. The important thing for us is customer choice. We kept all our branches open during the pandemic, ensuring all our customers could access their savings and mortgages in a way that works best for them.

“Whether a customer decides to deal with us in person at a branch office, by telephone, by post or online, the service they receive will be the same – friendly, informed, personal, professional and welcoming. All of the technological advancements are just ways to complement that service, and we remain committed to our ethos of opening and not closing branches.”

Results reflect our support for communities through pandemic

We are delighted to announce that we posted our best-ever set of results in 2020 as we benefitted from supporting our local communities by keeping our growing network of local branches across South Wales open through the pandemic. We also reaped the rewards of a five-year investment programme started in 2015.

Our total assets, mortgage balances, savings, capital and profits all reached record highs last year despite the challenges of the COVID-19 pandemic. This planned increase was the result of a comprehensive investment plan kickstarted in 2015, which saw us open three new branches, upgrade back-office systems and hire new talent.

Because they work in the financial services sector, our employees were classed as key workers throughout the COVID-19 pandemic as government wanted to ensure individuals had access to their finances. By keeping all of our branch offices open for face-to-face and telephone/e-mail contact, we were able to welcome many new savers and mortgage customers despite the challenges of the last 12 months.

For the 12 months to December 31, 2020, our total assets increased by £44 million to £414.4m, a growth rate of 12%; our mortgage balances increased by £29.6 million to £302.9 million, an increase of 11%; and our savings balances increased by £41.1 million to £386.8 million, a 12% rise. All of the growth in net mortgage lending was funded by increases in retail savings balances from personal customers deposits.

We posted a pre-tax profit of £3.3 million compared with the £2.3 million we made a year earlier in 2019. Although our levels of mortgage lending were slightly down due to the disruption of the pandemic (£67.1 million versus £74.3 million a year earlier) we also reduced our expenses to £4.8 million compared with £5 million in 2019. We have now delivered annual pre‐tax profits greater than £2m in each of the last seven years.

We are proud to remain one of the few financial institutions in the UK that receives no wholesale funding or support from the Bank of England in the form of cheap funding. Our balance sheet is funded entirely by customer savings balances and our own capital reserves built up from retained profits over many years.

We continue with our ethos of ‘opening not closing’ branches, in contrast to most financial institutions. We have opened new branches in Carmarthen, Cowbridge and Swansea City Centre in recent years. This benefitted us through the pandemic as more customers sought a personal, friendly and local service, and many savers, worried by economic crisis, also looked to spread their assets.

Alun Williams, our Chief Executive, said: “Despite the many challenges of the COVID-19 pandemic, the Society has weathered the health and economic disruption associated with the pandemic during 2020. We remained open and responsive to our customers throughout, which I think was appreciated by many local communities who were also, of course, staying local.

“It is our aim to enable individuals and families to realise their goals of a better and more secure future and the way we supported communities fitted well with that. We provided support to over 400 mortgage members with payment holidays. We also saw an uplift in savers coming to us, some of whom, concerned by the potential for a second banking crisis, were keen to spread their assets.

“In addition to that dynamic, in 2020 we truly reaped the rewards of the investment programme we started in 2015, not just in branches but in talent and infrastructure including IT. Last year was the first year for a while when there was no additional capital expenditure as part of that investment programme, which meant our expenses reduced.

“As ever, as a mutual, our profits will be reinvested into the business, strengthening our capital base so that we can continue to support our members and offer competitive savings rates and a personal, tailored and common-sense approach to mortgage lending with competitive mortgage products. They will be used for the future development of the Society as we consider further expansion and new branches across Wales.

“Despite the pandemic, 2021 finds the Society in a confident mood. The investment that the Society made in opening three new retail branches, refurbishing our Head Office in Cradock Street, and investing in new staff and improved IT systems, has started to pay real dividends.

“2021 will continue to be challenging and uncertain. The record low Bank of England Base interest rate is likely to remain low for a longer period. The Society will continue to adapt and deal with the challenges that arise head on, whilst continuing to deliver a first-class member service and growing our balance sheet and capital reserves in a controlled manner.”

We will hold our annual general meeting in a virtual form on Thursday 22 April 2021. Members can vote ahead of that meeting and we will donate a pound to Wales Air Ambulance for every vote received.

Swansea Building Society sees an increase in self-build enquiries

Here at Swansea Building Society, it’s great to see that an initiative rolled out by Welsh Government last year has encouraged more people to consider building their own homes. The success of the Self Build Wales scheme has led to us seeing a noticeable increase in mortgage applications relating to self-build projects.

Self Build Wales is designed to help more people in Wales build their own home. The scheme aims to remove the barriers and uncertainty around self-builds and custom-builds.

Figures suggest an average self-build house in the UK costs only 70-75% of its final value because no developer profits are involved. This puts that benefit into the pocket of the homeowner. At around 10% of new homes, the UK has a much lower rate of self-building than other countries around the world.

While Self Build Wales support is limited to the schemes designated plots, mortgage lenders offering self-build mortgages are not restricted to what they can finance. In Wales and the Welsh Borders, our Society’s personal and bespoke approach to lending makes it a natural port of call for all type of self-build lending whether it be for straight forward or more complex projects.

Since the launch of the Self Build Wales Scheme in March 2020, we have seen a steady stream of enquiries about this type of mortgage in spite of the challenges presented by COVID-19 and subsequent economic disruption.

Alun Williams, our Chief Executive Officer, said:

“We have always been keen to support individuals with ambitions to build their own homes, but since the Self Build Wales was launched, we have seen a sharp rise in enquiries – despite the economic disruption caused by COVID-19. We look forward to helping many more aspiring individuals achieve this dream in the future.”

One of our customers offered their thoughts on working with us on a self-build mortgage:

“Being aware of the successful support Swansea Building Society has given to a number of friends, family and clients we had no hesitation in asking them to assist with a self- build mortgage for our new family home near Aberaeron.

“The advice and support given by Sioned Jones, Area Manager at the Carmarthen Branch was comforting and made the whole process an easy step by step route to being able to build our home.

“The flexibility of their lending criteria and rates puts them at top of the list when it comes to wanting to move forward with buying a plot and developing. You remain in charge of the project; with Sioned and her team there to support you at any time you need. The application process is relatively short and hassle free.

“They have experienced valuers who visit the property before and during construction at key stages to release funds within days. The trust between everyone involved from start to finish cannot be underestimated. We would happily recommend them to anyone and everyone!”

We’re very pleased to be able to announce that our team, here at Swansea Building Society, has chosen to continue our support of Wales Air Ambulance as our official staff charity for another year.

The Wales Air Ambulance has been our official charity during 2020, following a vote by our staff. However, due to COVID-19, our staff felt that we have been unable to raise funds from many of the activities we would have liked to have undertaken, so would like the chance to do that in 2021, once, hopefully, restrictions are lifted.

Having said that, we have been able to raise a considerable amount for the valuable medical rescue service, helping it achieve its long-held ambition of becoming a 24/7 service across Wales, and allowing them to keep helicopters in the air during an unprecedented year.

The Wales Air Ambulance Charitable Trust welcomed the £5,000 donation we made in June, as well as the additional £5,000 donation we made at the end of last year – funds it said have been much-needed due to the way in which the coronavirus pandemic has limited many forms of fundraising this year.

The Society has also totalled up all monies from collection tins at our branches, which we have again more than match funded. This, along with a further individual donation from one of our customers of £250, brings the total raised for the charity by Swansea Building Society during 2020 to £10,718.

With UK charitable donations falling during lockdown, we understood that these donations would be greatly appreciated by this valuable medical rescue service – allowing them to keep helicopters in the air during an unprecedented year.

During 2021, our staff hope to be able to undertake the cake sales, dress down days, quiz’s, fundraising runs and cycle rides we had planned to raise money for the charity this year, meaning our total should, hopefully, surpass the already considerable amount we have managed to raise during 2020, despite the difficulties.

Wales Air Ambulance is funded entirely by the people of Wales. The charity does not receive direct funding from the government, and it does not qualify for National Lottery funding. Instead, it relies on the support of the Welsh public to help keep the helicopters flying. Its helicopters are kept in the air solely through charitable donations, fundraising events and membership of its in‐house Lifesaving Lottery.

The Charity has four airbase operations in Caernarfon, Llanelli, Welshpool and Cardiff. As well as flying patients to hospital, they bring A&E directly to patients.

The on‐board critical care consultants and practitioners have some of the most pioneering equipment and skills in the world. They deliver emergency treatments usually not available outside of a hospital environment, including the ability to conduct blood transfusions, administer anaesthetics, offer strong painkillers, and conduct a range of medical procedures. This means that patients receive advanced care before they even reach the hospital.

In December 2020, the Charity achieved its ultimate aim of becoming a 24/7 service. Alongside the four-aircraft operation which runs in the daytime, the Charity now has a helicopter and crew on standby throughout the night which is capable of supporting emergencies across Wales.

The money raised by the Society for Wales Air Ambulance adds to significant funds already raised for a variety of worthy causes during 2020: £1,000 raised for the Movember campaign; £2,820 raised for Maggies Cancer Charity; £1,071 raised for the Royal British Legion Poppy Appeal; £1,000 raised for the NHS; £500 for Carmarthen Food Bank; and £310 for the leading homeless charity Llamau West Wales.

Richard Miles, our Head of Savings, said:

“We had lots of group fundraising activities planned for 2020, but COVID-19, unfortunately, meant they were unable to go ahead. Despite these difficulties, our staff managed to raise a considerable amount during 2020. The Society has also stepped in with considerable donations to ensure none of the charities missed out – by more than match-funding all monies raised for the worthy causes we’ve supported.

“During 2021, our staff hope to be able to undertake some of the cake sales, dress down days, quiz’s, fundraising runs and cycle rides we had planned to raise money for charity this year. Hopefully, this should mean our 2021 total will surpass the considerable amount we have managed to raise during 2020, despite the difficulties.”

Mark Stevens, Wales Air Ambulance Fundraising Manager, said:

“Everybody at Swansea Building Society has shown incredible generosity towards our charity. We are humbled by their continued support and are proud to be associated with them.

“2020 has been a significant year in our history, and not just because of the pandemic. It is the year that we have achieved our aim of delivering a lifesaving service 24 hours a day, 7 days a week. To maintain the helicopter operation, we need to raise £8 million every year.

“During 2021, our charity will celebrate its 20th anniversary and we are delighted that Swansea Building Society will be a part of this significant milestone.”

We are very happy to announce that we, Swansea Building Society, have been added to The MCI mortgage club list of regional lenders.

The appointment provides further lending possibilities to the MCI’s growing membership, who take advantage of the club’s improved technology proposition. Members are supported through discounted and free technology solutions such as the Burrow digital broker platform, which provides a chat-style adviser interface and the eKeeper CRM to structure and streamline a broker’s back-office processes.

The MCI’s membership will now be able to take full advantage of our personalised, tailored, common-sense approach to lending with no credit scoring where all cases are manually underwritten.

This will include our mortgage products that cater for a wide variety of individuals and personal circumstances, including the self-employed, doctors, dentists, professionals, key workers, small holdings, short-term lending, lending in retirement and holiday lets.

Melanie Spencer, Head of the MCI mortgage club, said:

“The enhancement of the Swansea Building Society offers pragmatic lending options who assess all submitted cases on their own individual merit, which is crucial for more complex cases including those who are self-employed.

“The Swansea Building Society broadens the club’s offering to its members while being backed up by ‘best of breed’ technology options that generate genuine value to every member firm.”

Alun Williams, our Chief Executive, said:

“We’re delighted to be working with MCI. Swansea Building Society joining the MCI lender panel will mean that those who use MCI to source mortgages can access our wide range of personalised mortgage products.

“This is great news for those looking for the right mortgage – increasing their choice of available products – and also great for the Society. It is yet another example of how Swansea Building Society continue to expand and adapt to the times, whilst remaining true to its traditional ethos of offering a personal, tailored, and common-sense approach to lending with no computer-says-no mentality.”

Here at Swansea Building Society, we’re proud to have renewed our commitment to Mumbles by signing a new long-term lease on our premises and committing to a significant investment in refurbishing the branch – all as we celebrate the branch’s milestone 10-year anniversary.

The branch, which has been trading since 2010, achieved another excellent year in 2020 with savings balances reaching over £52 million. This helped our Society as a whole reach a new record of £386 million in savings balances on deposit at the end of December 2020.

The investment seen in the branch included the refurbishment of all three floors and shortly will see an electronic screen installed at the front window to give our customers more information about the Society’s products and services.

The success of our Mumbles branch is seen as proof that our ethos of dealing with customers on a face-to-face basis really works. As a result of this, we have been able to expand our network of branches in recent years to reach Carmarthen and Cowbridge and to relocate to bigger premises in Swansea while keeping our head office open in Swansea. A strategy which is in contrast with the high street banks, which continue to close branch offices across Wales.

In Mumbles specifically, HSBC and NatWest have both closed in the area since we opened there, and Barclays is now closed on a Wednesday. Lloyds Bank is the most recent to announce its intention to close its Mumbles office, with the final day of business being 21 March 2021.

Alun Williams, our CEO said:

“We have seen a lot of changes to the banking world in the Mumbles, with HSBC being replaced by Greggs and NatWest being replaced by Coco Blush – as well as the imminent closure of Lloyds.

“With our culture of ‘Opening not Closing branches’, our ethos has always been that we deal with our customers in a way that they want and not what they are forced to adopt. With all our branch offices having a front-line mortgage manager and friendly and experienced cashiers on site, we are able to deal with our customers on a face-to-face basis, being ready to handle their requests in a personal manner.

“By keeping the human touch alive in all our branches, we have found this to be the main catalyst to our continued success as the society grows year on year. We are looking forward to the next 10 years in the Mumbles branch and would like to thank all our customers for their ongoing support which is essential as we continue to maintain a banking presence in the Mumbles area.”

Covid 19 – Lockdown in Wales – Important News

Further to the recent Welsh Government announcement regarding the lockdown in Wales, please note that with immediate effect, our branches will be providing a counter service, available for deposits and withdrawals only until further notice. We respectfully request that our valued customers look to transact online, by e-mail, by post or over the phone wherever possible as we continue in our efforts to help keep everyone safe. Customers are now able to make electronic payments from their society account into a nominated bank account. For more information, please visit: https://swansea-bs.co.uk/customer-support/withdraw-monies-fraud-prevention Where a customer needs to open a savings account, this can only be undertaken via the post or by posting documents into a branch office post box. (Existing customers can e-mail a scanned copy of the application form.) Further information is available at: https://swansea-bs.co.uk/about-swansea-building-society/how-apply-for-savings-account

Please note that while our branches continue to be open on weekdays from 9.30am-4pm and closed on weekends, you are able to telephone your local branch to transact on weekdays between 9am to 4.45pm. (Please note our opening hours over the Christmas period are available here).

To assist the Society in our efforts to reduce the spread of the Coronavirus pandemic, there are several ways you can transact with the Society without entering the branch as follows:

- Cheque deposits / Passbook updates – please place your passbook (and if paying in, your cheque(s)) in an envelope and post it in the branch post box – we will send back your updated passbook by post. Please DO NOT pay in cash this way.

- Account opening – please place your completed application form and documents in an envelope and post it in the branch post box – we will post back your documents / passbook.

- General enquiries – please telephone your local branch to speak to a staff member. Details of your nearest branch are at: https://swansea-bs.co.uk/swansea-building-society-contact-and-directions

- Withdrawals by telephone / e-mail – we now offer an electronic nominated bank account withdrawal facility – please telephone your nearest branch for more information or visit: https://swansea-bs.co.uk/about-swansea-building-society/withdraw-monies-fraud-prevention

- Online – we now offer an online banking service – please call your nearest branch for more information or visit https://swansea-bs.co.uk/customer-support/online-registration

We would like to take this opportunity to thank you for your continued support in helping us ensure our customers and staff stay as safe as possible.

Our staff at our Carmarthen branch have been doing their bit to help people in need in the run up to Christmas.

We are proud to say that we have donated £500 to the Carmarthen Foodbank while, for the second year in a row, our staff have been working hard collecting food parcels for the charity.

Carmarthen Foodbank was set up by Towy Community Church in partnership with The Trussell Trust in September 2010 and later became part of the social enterprise the Xcel Project. It has fed more than 9,000 people and has been the fastest growing foodbank in Wales.

But our diligent staff did not stop there. Instead of buying gifts for each other via the traditional ‘Secret Santa’ they instead donated the money that would have been spent to LLamau West Wales, the homelessness charity in Wales that supports vulnerable young people.

Combined with an additional donation from the Society, they were able to donate a cheque for £310, which was gratefully received by the charity.

Llamau was founded 30 years ago to provide homeless teenagers with a safe place to stay. Since then, it has supported over 67,000 young people, women and their children who are either homeless or facing homelessness.

Sioned Jones, our area manager, West Wales Region, said: “It has been a tough year for everyone, but I am so proud of the staff here in the Carmarthen branch for their hard work and selfless attitude in the run up to Christmas. These are two very important charities and we are delighted to have been able to do our bit to help them.”

It’s wonderful to be able to raise a smile at the same time as raising funds for very worthy causes. So, it’s great news, here at Swansea Building Society, that our Head of Savings, Richard Miles, decided to grow a mighty ‘MO’ for the Movember Campaign.

Popular with the Celts, medieval knights, Victorian gentlemen, artists, philosophers, musicians and entertainers – from Salvador Dali and Fredrich Nietzsche to Errol Flynn and Freddie Mercury – the moustache has, over the centuries, been more fashionable at some times, less so at others – but has never disappeared entirely.

Derived from the ancient Greek word ‘mustax’, meaning upper lip, our French-English (probably Norman) version ‘moustache’, has come to represent that most iconic of male facial adornment, with an inordinate number of comedy and slang names, guaranteed to raise a smile.

Lip weasel, face furniture, cookie catcher, lip luggage, soup strainer – and many more that are too rude to mention here – the moustache is most often, these days, sported with a certain degree of knowing comic irony.

November or ‘Movember’ has, for the past few years, been the time when men around the world have refrained from shaving their top lip in order to raise funds and awareness for men’s health.

From humble beginnings in Australia in 2003, the Movember movement has grown to be a truly global one, inspiring support from over 6 million Mo Bros and Mo Sisters around the world and raising money for over 1,250 men’s health projects since its inception.

The main areas of focus for the campaign are raising awareness and funds for prostate and testicular cancer and, more recently, male mental health and suicide prevention. The movement aims to tackle these serious issues at the same time as allowing its participants to have fun – in their words: havin’ fun, doin’ good.

Here at Swansea Building society, we’re very happy, therefore, to have supported Richard in his fundraising efforts by more than doubling the amount he raised, which totalled £440, and have rounded the total up to £1,000!

Richard Miles, our Head of Savings, said:

“I think that the serious issues the Movember campaign tackle are very important. Us men are notoriously bad at looking after our own health and even talking about it. By having a bit of fun and growing a moustache for the month, I believe we can open up discussions around these topics, remove the stigma and taboo that often surrounds them, and raise funds for treatment and prevention of diseases that claim many men’s lives every year.”

“Growing my Mo certainly raised a few comments and smiles – which is the whole idea. By the end of the month, my daughter thinks I should have looked like Hopper off the Netflix series Stranger Things, though my moustachioed hero is probably Dave Grohl from the Foo Fighters!”

Swansea Building Society celebrates online success story

Swansea Building Society has hailed its investment in developing a new digital service that allows customers to access their savings and mortgage accounts online a success after one thousand seven hundred customers signed up to use its online banking portal in the first four months.

Swansea Online was launched in July following a significant period of research and development by the 97-year old institution, which wanted to strike the right balance between allowing customers easy access to their accounts, especially during lockdown, while offering security, assurance and choice.

The Society has welcomed high levels of adoption of the new platform in the first four months since rollout. While partly driven by COVID-19-related restrictions, the Society has kept all of its four branches open and operating throughout the Coronavirus crisis, while following guidelines around social distancing, to ensure customers have the choice they need – while also supporting the High Street.

Swansea Online allows the Society’s customers to view their savings and mortgage account balances online, transfer between Society savings accounts and withdraw monies from their Society savings account(s) to a nominated bank account which must be in their name/joint names (subject to terms and conditions).

Customers can also view previous transactions on savings and mortgage accounts and directly contact the Society’s highly-trained experts and advisors using a secure messaging facility.

The online platform has been set up with security and online safety as a priority. It will be accessible from any device including smartphones, tablets, laptops and desktop computers.

The Society stressed that this is not a replacement for its personal, face-to-face service, but simply an additional avenue for customers to engage with its staff and products and an especially helpful one in the context of social distancing measures, which remain in place post lockdown.

Alun Williams, Chief Executive of Swansea Building Society, said:

“We have been delighted by the way in which our customers have embraced Swansea Online and we look forward to encouraging even more members to use it in the future while adding to its functionality. The important thing for us is customer choice. We kept all our branches open during the pandemic, ensuring all our customers could access their savings and mortgages in a way that works for them.

“Our priority has always been to ensure our members are comfortable with the security of the platform but also still have access to the personal service we have always cherished and built our business around. Whether a customer decides to deal with us in person at a branch office, by telephone, by post or online, the service they receive will be the same – friendly, informed, personal, professional and welcoming.”

The Royal British Legion has welcomed a substantial donation of more than £1,000 from Swansea Building Society – funds it said are much-needed due to the way in which the coronavirus pandemic has limited many forms of fundraising.

The money was raised thanks to the tireless efforts of Lynda Jones, a cashier at Swansea Building Society, who raised £535.50 by making and selling poppies in the run up to Remembrance Sunday. Following match funding from the Society, the final cheque for £1,071 was written for the charity.

The Royal British Legion is a charity that provides financial, social and emotional support to members and veterans of the British Armed Forces, their families and dependants. With UK charitable donations falling during lockdown, a donation such as this has been greatly appreciated by this important charity.

Swansea Building Society, with branch offices in Swansea, Mumbles, Carmarthen and Cowbridge, has seen the fund-raising activities staff had planned for 2020 either cancelled or postponed due to COVID-19. However, Lynda refused to let anything stand in her way and spent months making poppies before selling them while observing social distancing guidelines in the run up to Remembrance Sunday.

Richard Miles, Swansea Building Society’s Head of Savings, said:

“These have been tough times for charities in particular and it is great to see one of our staff go the extra mile to raise money for such an important charity on such a significant day. As such, we were delighted to be able to match fund Lynda’s efforts to make an even more substantial donation.”

Alun Williams, chief executive of Swansea Building Society, said:

“It’s a great privilege to be able to support The Royal British Legion – particularly in light of the pandemic and the drop in donations to the charitable sector. I am very proud of the hard work and dedication of our staff despite difficult circumstances and Lynda epitomises those efforts.”

The Wales Air Ambulance Charitable Trust has welcomed our £5,000 donation – funds it said are much-needed due to the way in which the coronavirus pandemic has limited many forms of fundraising.

The Wales Air Ambulance is our official charity for 2020, having been voted for by our staff. With UK charitable donations falling during lockdown, a donation such as this has been greatly appreciated by this valuable medical rescue service. Unfortunately, many of the fund-raising activities our staff had planned for 2020 have either had to be cancelled or postponed due to COVID-19.

However, here at Swansea Building Society, we recognised the importance of being able to help Wales Air Ambulance with running costs during this period; unusually, therefore, we decided to make this sizable donation earlier than originally planned.

Richard Miles, our Head of Savings, said:

“Usually we would have given the full amount raised at the end of the year, but – due to the circumstances – we have made this donation earlier in order to help Wales Air Ambulance with their ongoing running costs. We had lots of group fundraising activities planned for the year, but COVID has, unfortunately, meant that they haven’t been able to go ahead. However, I’m sure that the staff will come up with some safe fundraising ideas to continue raising money over the next few months.”

Wales Air Ambulance is funded entirely by the people of Wales. The charity does not receive direct funding from the government, and it does not qualify for National Lottery funding. Instead, it relies on the support of the Welsh public to help keep the helicopters flying. Its helicopters are kept in the air solely through charitable donations, fundraising events and membership of its in‐house Lifesaving Lottery.

With four airbase operations in Caernarfon, Llanelli, Welshpool and Cardiff, Wales Air Ambulance can be there for anyone in Wales within 20 minutes. As well as flying patients to hospital, they bring A&E directly to patients.

The on‐board critical care consultants and practitioners have some of the most pioneering equipment and skills in the world. They deliver emergency treatments usually not available outside of a hospital environment, including the ability to conduct blood transfusions, administer anaesthetics, offer strong painkillers, and conduct a range of medical procedures. This means that patients receive advanced care before they even reach the hospital.

The helicopters currently operate 12‐hours a day, 8am to 8pm, but the Charity would like to run a helicopter 24/7 by the end of 2020. To achieve this, Wales Air Ambulance needs to raise £8 million every year.

Alun Williams, our chief executive, said:

“It’s a great privilege to be able to support Wales Air Ambulance this year – particularly in light of the pandemic and the drop in donations to the charitable sector. I am very proud of the generosity and ingenuity of the staff in raising the funds, despite difficult circumstances. Wales Air Ambulance needs to raise £8 million every year to operate the service and we hope the society’s efforts will go some way to helping them achieve this. Our charitable activities help to bring Swansea Building Society together as a team and allow us to give something back to the areas in which we operate. I’m sure that the remainder of the year will see us raise even more money for this vital service.”

Steffan Anderson-Thomas, Corporate & Events Lead for Wales Air Ambulance Charitable Trust, said:

“We very much appreciate the donation from Swansea Building Society. We are all working hard to achieve our aim of becoming a 24/7 service, and support like this will help to ensure we will be available for the people of Wales, around the clock. The staff at Swansea Building Society have done an amazing job raising these funds, particularly when you consider the events of the past few months, so we give heartfelt thanks to everyone who has contributed."

The Welsh Government has announced a 'fire break' national lockdown which will begin at 6pm on Friday 23rd October and end on Monday 9th November. The aim of the lockdown is for the public to stay at home to reduce the spread of COVID-19 unless absolutely necessary.

As a result of this, we would respectfully request that our valued customers look to transact online, by e-mail, by post or over the phone wherever possible during this period to help keep everyone safe.

Please can customers only visit a branch if they need to make an essential transaction that cannot wait until after November 9th - such as withdrawing funds to pay for food, bills, or rent.

Where a customer needs to open an account, please can they undertake this via the post or by posting documents into a branch office post box. (Existing customers can e-mail a scanned copy of the application form.) Upon receipt, we will then send back the documents provided by recorded delivery where physically received. Further information regarding opening an account by post / telephone is available at: swansea-bs.co.uk/about-swansea-building-society/how-apply-for-savings-account.

Please note that our branches will continue to be open to members on weekdays from 9.30am-4pm and closed on weekends. However, you will be able to call your local branch to transact on weekdays between 9am-4.45pm.

If you need to transact during the firebreak, you can:

- Telephone your local branch – contact details available at: swansea-bs.co.uk/swansea-building-society-contact-and-directions

- E-mail your local branch - contact details available at: swansea-bs.co.uk/swansea-building-society-contact-and-directions

- Transact using our My Accounts online banking service – further information available at: swansea-bs.co.uk/customer-support/online-registration

We would like to take this opportunity to thank you for your continued support in helping us ensure our customers and staff stay as safe as possible.

Following extensive consultation with mortgage brokers and customers, we are delighted to unveil a range of new fee assist mortgage products for our customers, where there is no arrangement fee to pay upon completion.

We are also making changes to our existing product range whereby we will allow arrangement fees to be added to the loan where the maximum product LTV limit has been reached*.

For the new fee assist products, while our customers will still need to pay an application and valuation fee (as well as any associated legal fees), removing the arrangement fee, which is typically one percent of the total value of the mortgage amount, represents a change for us in terms of our pricing of products.

For products where an arrangement fee is payable, we will allow customers to add this to the value of their mortgage, even if the maximum loan to value is exceeded, without affecting the interest rate charged*.

The new and revised products are available from October 1, 2020.

“We are constantly reviewing what we do and the products we offer to ensure we remain competitive and offer our customers the best possible solutions for their needs,” said our chief executive, Alun Williams.

“In this case, we have consulted extensively with both our network of mortgage brokers and our mortgage customers to re-evaluate our products in line with their expectations and recommendations.

“The result is a big change in the way arrangement fees are managed. This can be a big extra cost to people; these new products will allow customers to choose which option is best for them and their circumstances.

“The feedback on doing this has been very positive, against a backdrop of a bumper time for the housing market after the restrictions of COVID-19 were eased. We think these adjustments to our offering makes our products very attractive in what remains a competitive environment.”

*Except for the self-build, renovation and Buy to Let 70, Consumer Buy to let 70 and Holiday Let 70 products.

After speaking extensively with our mortgage brokers and customers, we are delighted to introduce a new mortgage product specifically designed for medical professionals – offering them enhanced terms and a better deal.

The Medical Professional Mortgage Product is designed specifically for cases where the applicant, or one of the applicants in the case of a joint mortgage, is a medical doctor, surgeon or dentist. They might be looking to purchase a property, re-mortgage from another lender, or raise capital against equity in a property.

This new product also allows our customers to borrow a higher amount against their income compared with standard mortgage products, subject to meeting affordability rules. Sole customers will be able to borrow up to 5.5 times their sole income (the standard criteria is a multiple of 4.5) while joint customers will be able to borrow up to 5.0 times their joint income (the standard criteria is a multiple of 3.5).

The new products are available to customers from October 1, 2020.

“We are constantly reviewing what we do based on feedback from customers, brokers and our wider analysis of the mortgage landscape to ensure we are competitive where relevant in the current market,” said Alun Williams, our chief executive.

“In this case, we wanted to develop a product that would reflect the current and future earnings potential of some of our clients who work in the medical profession. We are delighted to be able to roll this product out from October 1; we have already had very good feedback from our network of brokers.”

Here at Swansea Building Society, we are proud to have been able to add key workers from a number of sectors, all of whom have played a critical role in helping the UK through the COVID-19 pandemic, to the list of professions that are eligible for enhanced terms.

Our ‘Professional’ Mortgage product offers a lower interest rate to individuals in a range of professions ranging from accountants to engineers to solicitors to architects.

Now, in recognition of the critical role keyworkers from many professions played in the country’s battle with COVID-19, we have added 11 additional professions to our list of those eligible for the product.

Bank workers, delivery drivers, military personnel, pharmacy workers, mail carriers, utility workers, farmers, truckers/lorry drivers, grocery shop workers, carers and medical workers such as paramedics have all been added to the list.

The updated eligibility list will apply from October 1, 2020.

“The coronavirus pandemic brought huge challenges for the country and, like everyone else, Swansea Building Society has huge admiration for the key workers that kept the economy moving through unprecedented times,” said Alun Williams, our chief executive.

“The staff in the NHS did an incredible job but there were also many other keyworkers in different industries that worked through the pandemic. We wanted to do something that recognised their efforts and felt that adding them to our list of professions eligible for our Professional Mortgage product was the right thing to do.”

From Monday 14th of September, all persons over the age of 11 visiting a Society office (Branch or Head Office) will be required to wear face coverings at all times during their visit.

Only those who are exempt will not be required to wear a face covering and we would respectfully ask all customers to adhere to the new mandatory rules issued by the Welsh Government.

Where customers refuse to wear a face covering for no valid reason, staff will refuse entry to the customer / ask them to leave.

Please remember it is your responsibility to now source and carry a face covering with you whilst this rule is in place.

Thank you for your co-operation.

Swansea City is pleased to announce the continuation of its partnership with Swansea Building Society for the forthcoming 2020-21 Championship campaign.

In the second year of a three-year deal between the club and the building society, the local institution will now feature as the club’s official first-team back of home shirt sponsor and will remain as an official lounge partner. This will see the executive lounge on the third floor of the Liberty Stadium continue to be named the Swansea Building Society Lounge.

Founded as a mutual building society in 1923, Swansea Building Society is one of only three remaining mutual societies in Wales. It is also the only building society or bank with its headquarters in west Wales.

“We are delighted to be again working with our valued partner Swansea City on a new sponsorship deal that is mutually beneficial to both parties," said Alun Williams, chief executive of Swansea Building Society,

“Community is at the heart of everything we do, and this partnership allows us to get closer to our customers. By maintaining these core values, we have enjoyed strong growth in recent years allowing us, in turn, to expand our footprint across the region.

“We have been opening branches, rather than closing them as so many other financial institutions have been.

"We feel we are now set on a very positive path for further growth and prosperity, which we can now celebrate alongside our partner Swansea City.”

Rebecca Edwards-Symmons, Head of Commercial at Swansea City, added: “I am thrilled that Swansea Building Society have continued to support the club and for us to have them on our back of home shirt for the 2020-21 season is fantastic.

"Moreover, to have premium Swansea-based businesses on our kit makes this season very special.”

Members of Swansea Building Society will now be able to securely access their savings and mortgage accounts online for the first time, following the launch of Swansea Online, a new digital service by the 97-year old institution.

The Society’s customers will now be able to view their savings and mortgage account balances online, transfer between Society savings accounts and withdraw monies from their Society savings account(s) to a nominated bank account which must be in their name/joint names (subject to terms and conditions).

Customers will also be able to view previous transactions on savings and mortgage accounts and directly contact the Society’s highly-trained experts and advisors using a secure messaging facility.

The online platform has been set up with security and online safety as a priority. It will be accessible from any device including smartphones, tablets, laptops and desktop computers.

The Society stressed that this is not a replacement for its personal, face-to-face service, but simply an additional avenue for customers to engage with its staff and products and an especially helpful one in the context of social distancing measures, which remain in place post lockdown.

Swansea Building Society’s four branches have remained open during the Coronavirus crisis, while following guidelines around social distancing.

Alun Williams, Chief Executive of Swansea Building Society, said:

“We have been working on launching an online offering for some time, but our priority was always to do so while ensuring that our members would be comfortable with the security of the platform and have complete assurance that their money is safe. The system is secure and uses a two-step sign in process, giving another safe option to manage accounts. Whether you're at home or on the go, Swansea Online will allow members access to their accounts whenever they need it and in a way that's easiest for them.

“Of course, this is an additional service and point of contact for our members and not a replacement for the personal service we have always cherished and built our business around. Whether a customer decides to deal with us in person at a branch office, by telephone, by post or online, the service they receive will be the same – friendly, informed, personal, professional and welcoming.”

To register for Swansea Online, go to: online.swansea-bs.co.uk and then follow the instructions to register. Once activated, customers will have 24/7 access to their mortgage and savings accounts*.

Any questions regarding registering for online access, can be sent to the Society’s dedicated online team by e-mail at: online@swansea-bs.co.uk or call into or telephone one of the Society’s branch offices across South Wales

Coronavirus (COVID-19) 3 Month Mortgage Payment Holiday

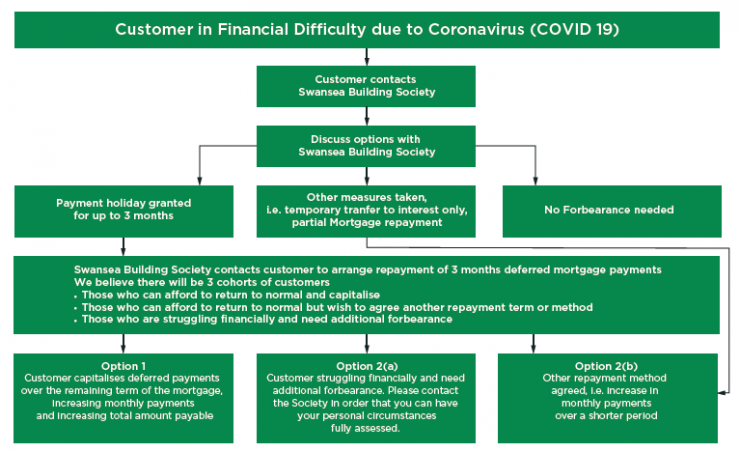

Following the recent announcement from the FCA we are continuing to support our customers affected by Coronavirus. The Society has helped many of our mortgage customers during these unprecedented times by offering a 3-month mortgage payment holiday. As this payment holiday period will be coming to an end shortly, we are committed to keeping our customers informed about what happens next to get their mortgage payments back on track.

The FCA guidance recommends that if you are able to maintain your mortgage payments, you should do so.

We will be writing to all customers one month prior to their mortgage payment holiday ending, to let them know what their new monthly mortgage payment will be, and when the new mortgage payments will begin, and offering the following options:

Option 1

The monthly interest charged to the mortgage during the 3-month payment holiday period will be added to the mortgage balance and repaid over the remaining term of the mortgage.

This means that you will see an increase in your monthly mortgage payments once your mortgage payment period is over and the amount of interest payable under your mortgage contract will have increased.

Option 2a

You may opt out of capitalising the interest and discuss an alternative arrangement directly with a member of our staff, which will suit your individual circumstances.

Option 2b

If you are worried about paying the new mortgage payment our mortgage administration team will be able to discuss your options further, based on your individual circumstances, as you may be able to apply for a mortgage payment holiday extension (see below).

Click Here for a flowchart explaining the options.

When will I be written to regarding the options?

- For customers re-commencing their mortgage payments in June, we will be writing to you in early May;

- For customers re-commencing their mortgage payments in July, we will write to you in early June; and

- For customers re-commencing their mortgage payments in August, we will write to you in early July.

Please can we ask you to not contact us before receipt of the letter you will shortly receive from us as detailed above unless you cannot afford to re-start your mortgage payments on the due date.

If you normally pay by direct debit, we will automatically collect your payment from your bank account. If you don’t pay by direct debit or have cancelled your direct debit, you will need to make other arrangements to make the payment.

What happens if I need a mortgage payment holiday extension?

If you are unable to maintain your mortgage payments at the end of your payment holiday, then we may consider a payment holiday extension of up to 3 months.

If you require further support, we will need you to supply us with the following information to help us guide you to the best possible solution to suit your individual circumstances. We will need;

1. A fully completed statement of personal details (click here)

2. 3 months bank statements for ALL bank accounts held

3. A letter explaining your circumstances for requiring the payment holiday extension.

We appreciate you might be concerned about the impact of coronavirus and want to reassure you that we are here to help you with any concerns you have about your mortgage.

Further advice and support can be found at the following websites

www.moneyadviceservice.org.uk

www.fca.org.uk

Remember, during April we wrote to you to confirm we have reduced all of our existing customer mortgage interest rates with effect from 1st May 2020 to further help our customers with their future monthly mortgage commitments.